THE DEBT NERD

SAY GOODBYE TO DEBT. SAY HELLO TO FREEDOM.

©Copyright 2025, The Debt Nerd

WELCOME!

We are, The Debt Nerd

We’re a private debt solutions advocacy group focused on contesting unsubstantiated claims and ensuring that any party requesting payment can legally demonstrate their right to collect. Whether it’s THIRD PARTY INTERLOPERS (DEBT COLLECTORS, AGENCIES, DEBT SOLICITORS), PARKING CHARGE NOTICES, ENERGY COMPANIES, ALLEGED CREDITORS, DEROGATORY CREDIT REPORTING, LOCAL COUNCILS (yep, even them!), or countless others.

"We’re helping households and individuals across the UK protect their property and push back against unfair claims or money demands."

Scroll to learn more.

THIS IS NOT A FINE

it's an offer

A Parking Charge Notice isn’t a fine, it’s simply an offer to contract, with a 14-day window to respond. Take control, act early, get informed by learning how to accept or reject the offer confidently. Learn how to respond the right way by unlocking the facts.

STart taking back CONTROL

Are you receiving debt collection or demand for payment letters in the mail? Have you been making payments toward debt you assumed you owed, without verifying its validity or lawfulness?

STOP NOW!

You have the right to suspend those payments immediately and begin our dispute process. Don’t pay another penny until you’re sure the debt is legitimate. Discover how we can assist you in possibly claiming back money that is rightfully yours and challenging any alleged debts pursued by creditors or debt collection agencies. Our proven dispute method empowers you to lawfully and effectively protect your financial interests.

SOUND GOOD?, LET'S CONTINUE

FEELING DEBT SHAMED?

DON'T WORRY

Most people feel embarrassed or ashamed when they’re faced with 'allegegations' of debt, and financial demands, but there’s absolutely no reason to be. What matters most is taking the right steps to deal with it. Remember, you’re not alone, and there’s no shame in seeking help to make those claims disappear.

HOW TO GET STARTED?

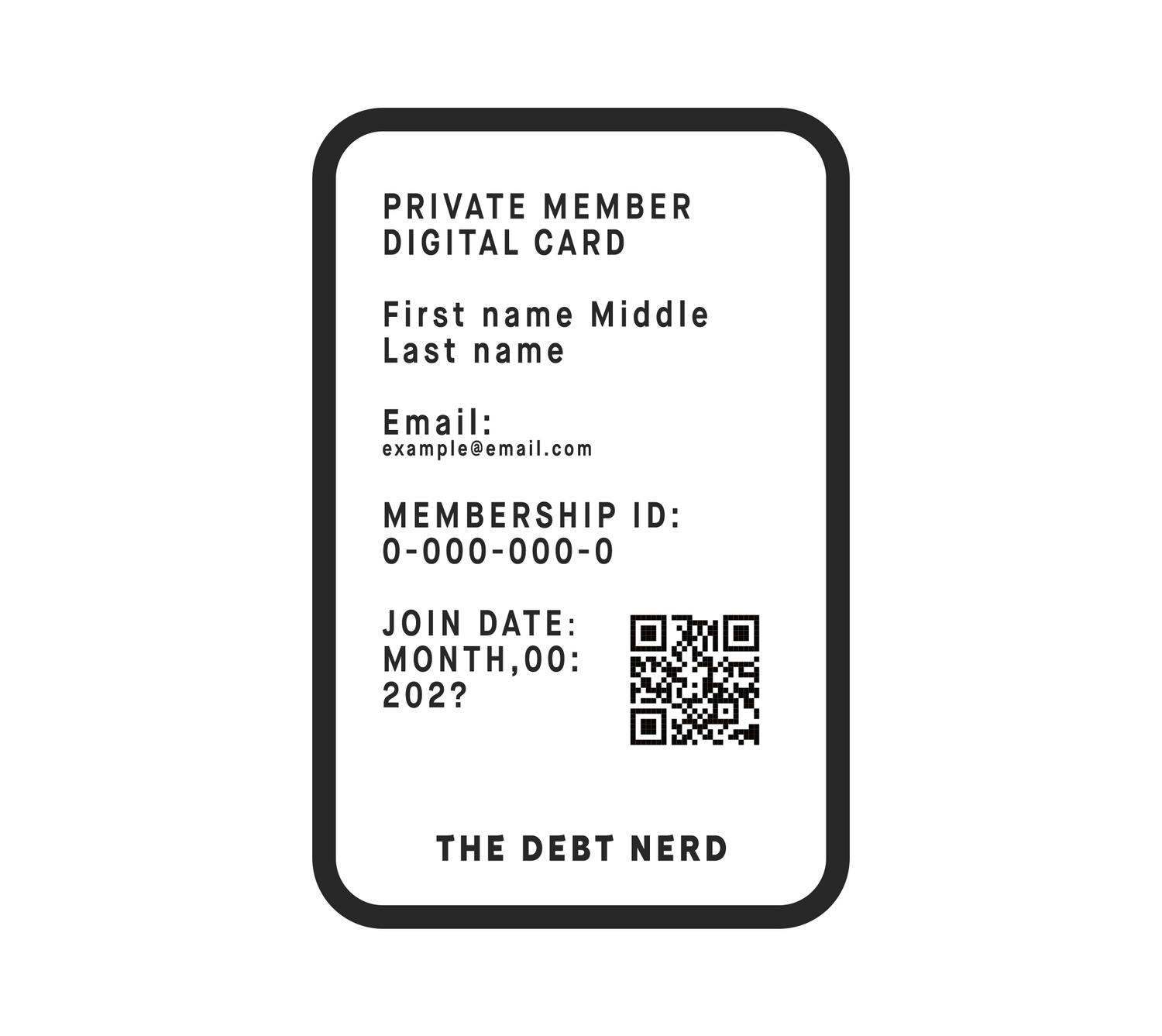

1. Decide on the dispute kit that best suits your needs.2. Sign up to become a Private Member.3. You’ll receive your membership card and a link to complete your purchase.4. Once you've received your file, you're all set to begin.

Need help with your kit? We're here to assist! Please note: inquiries beyond kit-related support may incur consultation fees.

presumption vs law

knowledge is power

At The Debt Nerd, we don’t deal in presumptions, assumptions, or opinions. Every claim dispute we support is grounded in solid facts and irrefutable proof sourced directly from the laws that uphold your legal rights.

GET your FREE CONSULTATION

Get a free consultation to understand your rights and discover how our debt dispute process can help you challenge invalid claims and regain control.

This one-time consultation is exclusively available to private member accounts after purchasing their dispute kits. It's the perfect opportunity to get clarity and support at no cost. Please note: any additional consultations beyond this initial session will be subject to standard service fees.

DEBT is big business

DID YOU KNOW?

In the UK, debt collection companies often purchase debts for just a fraction of their face value, yet they typically demand payment of the alleged full amount. At Debt Nerd, we not only help you dispute these claims of debt made against you, but we also assist you in claiming back the amounts they have sought from you.

THREATS OF COURT ACTION?

The law offers a wide range of remedies for issues involving goods and services, unfair contracts, data protection, debts, and more. Through our own lived experiences navigating these challenges, we’ve developed our starter packs as practical tools rooted in everything we’ve learned and successfully applied. These packs are built on legal principles, not assumptions, because facts, not fear, are what matter most. One key legal maxim to always remember is: “He who makes the claim bears the burden of proof.” Just because someone makes a claim against you doesn't mean you must accept it without question. A claim is simply that - "a claim", and every claim has the right to be challenged, scrutinised, and responded to lawfully.At Debt Nerd, we believe that challenging questionable debts shouldn’t be stressful or confusing — it should be smart, simple, and empowering. Our mission is clear: to help you stand tall, assert your rights with confidence, and navigate the debt dispute process with clarity .

LEARN HOW TO

FIGHT BACK CONFIDENTLY

Our dispute process is built to protect your rights while holding the claimant accountable. It formally notifies the alleged collector and shifts the burden of proof onto them , where it belongs.

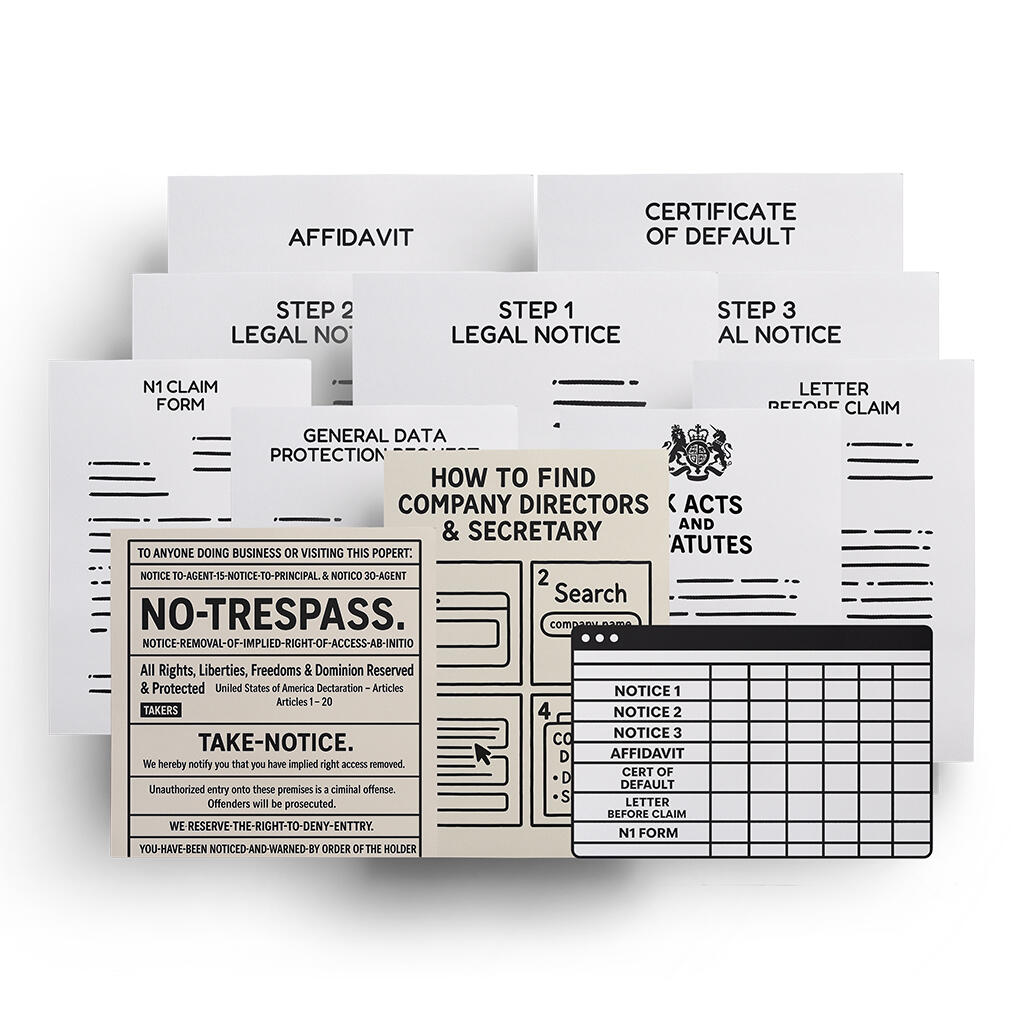

HOW IT WORKS

We built a powerful debt dispute process as a practical tool to help individuals challenge claims and financial demands made against them. Every step in our kits is grounded in law, giving you the confidence to respond legally and effectively, no matter who’s making the claim. Our administrative process aligns with official government statutory and regulatory duties, ensuring your responses are compliant and professionally structured. We focus on early action for best results, but if you're responding later, we've got you covered. This kit is for anyone ready to take control, offering a structured, professional way to push back and reclaim peace of mind.

credit affected by debt?

let's get that sorted

A key part of our process focuses on disputing derogatory credit reporting tied to alleged debts that have not been properly validated. Our more advanced kits are designed to help you challenge and correct negative credit entries resulting from inaccurate or unverified claims, giving you a stronger path toward restoring your credit profile.

TESTIMONIALS

WE'RE 1 IN A MILLION

WHAT MAKES US UNIQUE?

The key difference between our approach and the more common, one-size-fits-all advice offered by most commercial "debt management" advisers is this: they typically guide people toward setting up a Debt Management Plan (DMP), an Individual Voluntary Arrangement (IVA), or in Scotland, a Trust Deed, as IVA's aren't available there. Other routes often suggested include a Debt Relief Order (DRO) or even Bankruptcy. Whilst we acknowledge that "some" of these can be responsible and valid options, our focus is on a different path, something called "PROPER VALIDATION OF DEBT." It involves verifying the accuracy and quality of data, and also proving or confirming the validity of a claim.

save the best for last

take it all the way

Upon completion of our process, you may be positioned to pursue a summary judgment and seek all applicable remedies available under the law, including but not limited to damages for unlawful breach, harassment, and violations of your statutory rights. Our framework is structured to support a lawful and evidentially sound course of action.

CHOOSE THE RIGHT TOOL

Each of our kits is built for a specific stage of the debt dispute journey. Whether you're just getting started or ready to take legal action, there's a kit here to help you move forward with clarity and control.

SELECT YOUR KIT BELOW.

STARTER

ESSENTIAL KIT

SILVER

£300

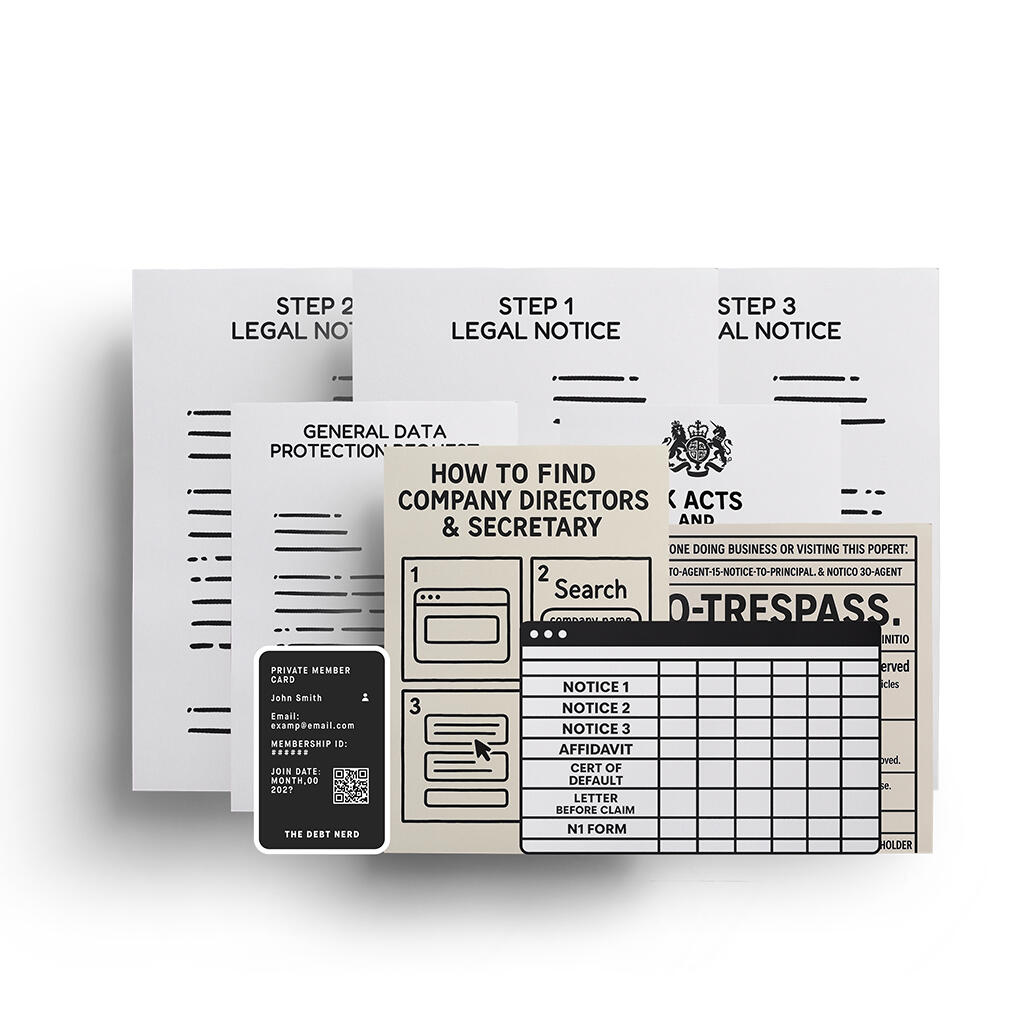

The Silver Kit is the ideal first step for anyone facing an alleged debt. It covers the basics, guiding you through initial responses and validation requests to ensure you're not paying without proper proof. Designed to establish a strong foundation, this kit helps you assert your rights early and confidently.

3 Notices

HTFCDS Guide

Acts & Stats, Digital Private Members card

INTERMEDIATE

CORE KIT

GOLD

£425

The Gold Kit is built for those ready to go beyond the basics and push back with confidence. It offers a stronger foundation and a wider range of tools to challenge alleged debts, respond firmly to persistent collectors, and protect your legal rights. Ideal for anyone prepared to take a more assertive stand.

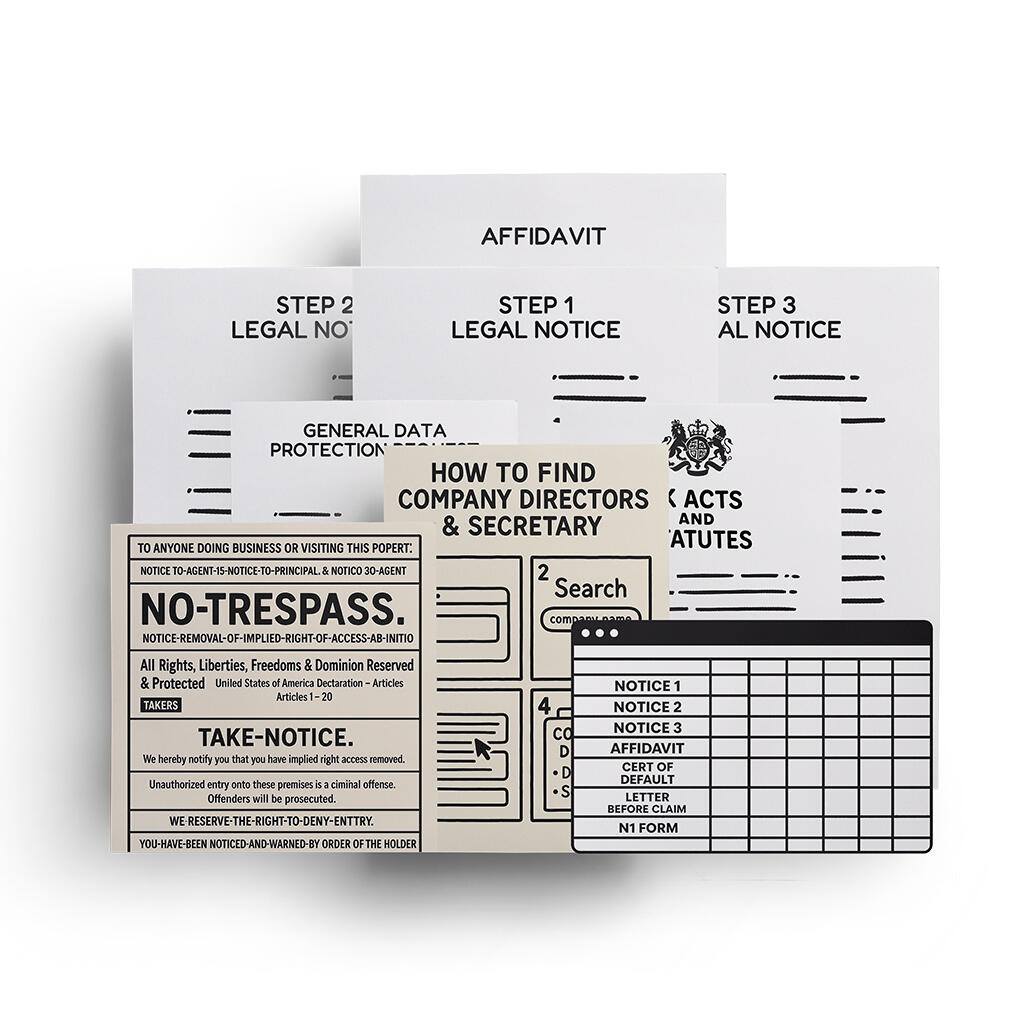

3x Notices, GDPR, Cert of Default

HTFCDS Guide, Acts & Stats

Tpass Notice, Digital Private Members Card

PREMIER

ELITE KIT

PLATINUM

£950

The Platinum Kit is built to support legal escalation when needed, offering powerful tools to challenge complex debt claims. It also helps you address and suspend previous payments made before you were aware of your right to demand proper validation. With this kit, you can assert your legal position and move forward confidently toward potential remedies.

3x Notices, GDPR, Affidavit, Cert of Default, N1 Form, Acts & Stats, Record Keeping SS

HTFCDS Guide, Claim Form Guide, LBC Letter

Trespass Notice, CH Charge Form, 3 Step Credit Repair, Digital Private Members Card, plus more

SUPREME

DIAMOND KIT

DIAMOND

£950

The Diamond Kit is our most advanced and strategic solution, designed for those ready to challenge alleged debts and take action against unlawful demands. It empowers you to dispute invalid claims and pursue legal remedies, providing a clear path toward summary judgment and the compensation you may be entitled to under the law.

3x Notices, GDPR, Affidavit, Cert of Default, N1 Form, Acts & Stats, Record Keeping SS

HTFCDS Guide, Claim Form Guide, LBC Letter

Trespass Notice, CH Charge Form, 3 Step Credit Repair, Digital Private Members Card, plus more

managing expectations

during the debt dispute process

Our administrative debt dispute process is designed to make things as easy, clear, and stress-free for you as possible. However, it’s important to understand that debt is a business- and those demanding money may push back. This resistance is mostly just noise than substantial. The laws we rely on are exactly that - the law, and they are on your side. Creditors or collectors may attempt to bluff, pressure, or provoke a reaction to see if you’re serious. But remember: a claim without proper validation is just a claim. The burden of proof always lies with the party making the demand. Once your dispute is in process, any collection actions should stop until the debt is properly validated. So stay confident, you’ve taken the right step, and we’re here to help you through it.

DISCLAIMER

WE ARE NOT LEGAL ADVISORS

©Copyright 2025, The Debt Nerd

UNLOCK YOUR POWER NOW!

the debt nerd Private membership

join today

©Copyright 2025, The Debt Nerd

YOU DID IT!

Thank you for starting your debt dispute with us! Your private membership is in the works, and we're excited to have you on board!

We want to remind you that whilst our process is designed to be as stress-free as possible,

you may still experience pushback from creditors or collectors. This is mostly just noise. Remember: the law is on your side, and 'they' are required to validate their claims first before anything. You’ve taken the right step, and we’re here to help every step of the way.

created your private membership?

WHAT NOW?

Once your private membership account has been successfully created, you'll receive your chosen kit, and your personalised membership card either via email, or a link shortly after. This card is your key to unlocking all the exclusive benefits and services we offer.

Membership REGISTER?

| NAME | KIT | Year | ID# |

|---|---|---|---|

| RASM | Platinum | 08/25 | 0-117-120-X |

| LADS | Silver | 08/25 | 0-211-180-X |

| CDG | Silver | 08/25 | 0-315-210-X |

STATUS ACCESS

You’ve reached the Private Members Register via the QR CODE on your digital membership card. This page is built for quick status lookup and shows your name acronym, your Dispute Kit, your join date, and your unique ID registration number. For your privacy, please keep this page secure.

©Copyright 2025, The Debt Nerd

DISCLAIMER

Private Administrative Dispute Process – Important NoticeThe Debt Nerd is not a legal representative, attorney, or financial advisor. All information shared is provided solely for educational and informational purposes only and should not be construed, or considered as legal, financial, or professional advice. For guidance regarding debt, finance, or related matters, please consult a qualified legal representative or licensed financial professional.This Private Administrative Dispute Process has been developed as an educational resource intended to inform and empower individuals in navigating debt-related issues. It is not legal advice, nor a substitute for professional counsel. While the materials provided are designed to be clear, practical, and supportive, there are no guarantees of outcome. Each situation is unique, and success depends largely on your own persistence, willingness to learn, and the actions you choose to take.This process is structured to help you identify inconsistencies, misinformation, or questionable practices that are often present in debt collection activities. It provides a framework to request proper validation of claims, reduce harassment, and, in some cases, explore recovery of payments made under circumstances that may not have been lawful.It is important to emphasize that we do not advocate avoiding verified and legitimate obligations. Where a genuine contractual debt exists, fulfilling that obligation remains both lawful and appropriate. The purpose of this process is to ensure that any claim brought against you is properly validated and supported by evidence, as is your right.While this material draws from extensive research and practice, it is intended solely as a guide. Every individual case will differ, and no document, template, or process can promise results. Your decisions and actions are your responsibility alone. We cannot and do not act as legal representatives, and we assume no liability for the choices made based on this material.Debt collection is a business, and while many agencies operate within lawful boundaries, others may employ practices that are misleading or unverified. This process aims to help you recognize those practices, assert your rights, and proceed with clarity and confidence.Above all, this resource has been created to support individuals in taking ownership of their financial journey. We encourage you to approach it with diligence, integrity, and responsibility. Always verify, never assume, and remember: the ultimate direction of your process rests with you.

©Copyright 2025, The Debt Nerd